How SaaS CEOs justify brand investment while still driving short-term pipeline and CAC efficiency.

I’ve sat in more than a few meetings where the sales leader and marketing leader were politely — but unmistakably — at war.

The CRO was waving a dashboard showing a dip in pipeline coverage and declaring, “We need more leads. Now.”

The CMO, equally poised, countered: “We can’t keep paying more for the same leads. We’re feeding the machine faster than we’re fixing it.”

It’s a familiar tension. The CRO is under pressure to make the quarter. The CMO is trying to keep the brand from eroding. The result? A tug-of-war that plays out in nearly every SaaS leadership meeting I’ve been part of.

As CEO, you’re left in the middle — the referee of a high-stakes game where everyone’s calling for a different play.

For years, you could get away with tilting your mix toward performance. But that game is changing. Paid channels are getting more expensive, and AI is rewriting the rules of discoverability. Brand is no longer just about perception — it’s about how you’re found and trusted in an LLM-driven world.

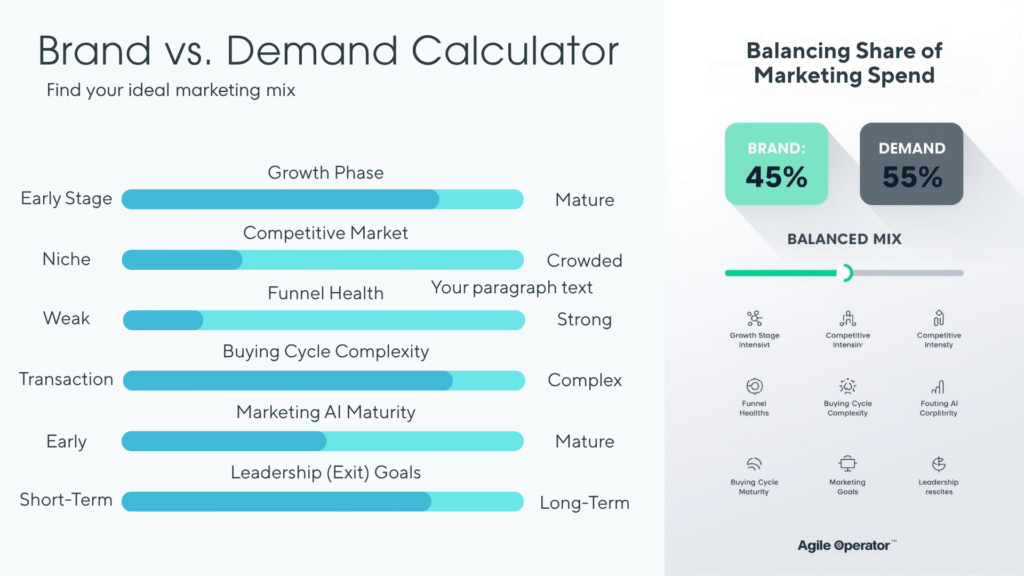

In this article, I create a framework for operators to rationalize this problem and provide thumb rules based on six factors to help maintain the right mix. I’ve also built a simple Brand vs. Demand Calculator that can help articulate your position.

The Pressure Cooker: SaaS Growth in 2025

Every SaaS CEO I talk to feels the same heat: bookings pressure, shorter cycles, and higher scrutiny from boards and investors.

Research shows the average B2B buying cycle has stretched to six to nine months while marketing budgets have shrunk by double digits (Gartner, 2024). And competition? It’s up more than 20% YoY in most SaaS categories.

So what happens? Many companies cut brand spend and double down on lead gen — the quick fix that feels good for about a quarter. But the hidden cost is brutal: higher CAC, lower conversion rates, and weaker share of voice.

Why Brand Still Matters (and Maybe More Than Ever)

Your brand is your trust layer. It tells buyers, “You’re safe betting your next quarter on us.”

Strong brands accelerate growth. According to Brand Finance, the top 150 B2B brands grew 8% year-over-year, proving that trust and reputation drive commercial growth (Brand Finance, 2024).

But here’s what’s new: as search behavior shifts from Google to generative AI, your brand presence becomes your new SEO. See our post Demand Gen in the Era of Zero Click Searches

When a prospect asks ChatGPT or Perplexity, “Who are the leading SaaS vendors for data governance?”, those models aren’t pulling your ads — they’re pulling from your earned media, backlinks, and thought leadership.

As Search Engine Journal recently noted, “Brand still wins, even in AI search” (SEJ, 2024).

“Brand still wins, even in AI search.” — Search Engine Journal

That’s why I’m bullish on the resurgence of earned media — PR, analyst coverage, guest podcasts, and owned thought leadership. It’s not vanity. It’s the fuel that trains LLMs to find you first.

Consistent PR and media presence can significantly boost a company’s authority and visibility. Coverage in reputable outlets like Forbes or TechCrunch, mentions in industry reports, podcast guest spots, and thought leadership articles all build a brand’s digital footprint. Over time, search algorithms and Large Language Models (LLMs) use this digital record to recognize the brand’s expertise. Smaller efforts, like contributing to niche blogs, responding to journalists on HARO, or staying active on LinkedIn, also create valuable signals that AI systems use to measure a brand’s influence.

Organizations investing in earned media become essential to both AI systems and human audiences.

📊 Key Stat: Top B2B brands grew 8% YoY (Brand Finance, 2024)

Why Demand Still Rules (and You Can’t Ignore It)

Let’s be clear — you can’t make payroll on brand equity.

Demand generation remains the operational engine driving your business: generating MQLs, fueling SDR outreach, and building pipeline coverage. It’s measurable, immediate, and non-negotiable.

However, its efficiency is under greater challenge than ever. Paid media fatigue is a significant hurdle, and without a strong brand to build trust, conversion rates suffer while customer acquisition costs (CAC) climb. Studies confirm this struggle, showing that only 33% of SaaS companies are meeting their conversion benchmarks from MQL to closed-won deals (Klickflow, 2025).

Abandoning demand generation isn’t an option. Instead, the focus must shift to more thoughtful execution. Proven methods like targeted account-based marketing (ABM), value-driven content syndication, and highly relevant paid search campaigns still deliver results when executed precisely. The key is leveraging robust analytics and AI-powered tools to optimize every stage of the funnel. These technologies enable you to identify high-intent signals, personalize outreach at scale, and allocate budget to the channels delivering the highest ROI, ensuring your demand engine runs as efficiently as possible.

📊 Key Stat: Only 33% of SaaS companies meet conversion benchmarks (Klickflow, 2025)

The Brand–Demand Tug-of-War: Finding Your Balance

Every SaaS company lives in this tension. CEOs demand measurable efficiency; CMOs push for brand depth that can’t be captured in a quarterly dashboard. The truth is, brand and demand aren’t rivals—they’re levers. The art lies in knowing which one to pull harder, and when.

Historically, the 60/40 split—60% investment in brand-building and 40% in demand generation—has been championed as the gold standard for long-term growth in B2B SaaS. While this rule of thumb provides a useful starting point, it is far from universal. Modern marketers must critically assess their unique market dynamics, growth stage, and audience behavior to determine if this balance holds true for their context. Rigidity in adhering to historical benchmarks can hinder strategic optimization, as data and situational nuance often demand tailored adjustments to maximize impact.

To strike the right balance, SaaS leaders must analyze their strategic context. Here are the six critical factors that determine where your investment slider should be set:

- Growth Stage

- Early-stage startups (≤ $10M ARR) should lean heavily on demand (70–80%)—prove the model, test offers, and feed the pipeline.

- Scaling companies ($10–50M) start to feel the drag of recognition gaps. Dial brand up to 40–50% to establish category credibility and preference.

- Mature SaaS firms ($50M+) with steady revenue can afford a 50/50 or even 60/40 brand tilt, protecting market share and commanding price premiums.

- Competitive Intensity

- In crowded markets, brand is the only true moat. If your competitors are running the same LinkedIn ads with the same value props, push brand +10 points to break out of the noise.

- If you operate in a niche or emerging space with few direct rivals, shift demand +10 points to capture share before the market gets noisy.

- Funnel Health

- Low conversion rates often signal a trust gap. If MQL→SQL falls below 10%, you’re over-spending on demand. Redirect 10–15 points to brand for credibility programs.

- If you’ve got strong conversion efficiency but low top-of-funnel velocity, tilt demand +10–15 points to widen reach.

- Buying-Cycle Complexity

- Long sales cycles (6–12 months) reward sustained brand familiarity—prospects need multiple trust impressions before they buy. Move brand +5–10 points.

- Transactional or product-led cycles (< 3 months) benefit from higher demand spend and conversion-focused messaging.

- Marketing AI Maturity

- Teams with strong data pipelines, predictive scoring, and AI-assisted attribution can optimize demand dynamically. Keep brand steady (~40%) and let the model fine-tune spend weekly.

- If you’re still flying blind on attribution, invest more in brand (50–60%)—earned trust will smooth the inefficiencies your data can’t yet detect.

- Leadership Goals

- A short-term exit or PE liquidity horizon calls for a demand-heavy mix (70/30) to show rapid payback.

- A long-term category-lea”Without brand, you’re renting demand at an increasing price.”dership play demands brand +15 points, anchoring reputation that outlasts funding cycles.

When you quantify these factors, the budget conversation stops being about opinions. It becomes a data-driven calibration—a balance between tomorrow’s bookings and next year’s valuation.

Establish Guardrails

To maintain the right balance between brand and demand, track these critical metrics as guardrails. They act as your early-warning system.

- Pipeline Coverage: Maintain at least a 3× pipeline coverage to ensure you have enough qualified opportunities to hit your revenue targets.

- Lead Qualification Rate: Keep your MQL→SQL conversion rate at or above 12–15%. A dip here could signal a problem with lead quality from your demand-gen efforts.

- Sales Conversion Rate: Hold your SQL→Win rate at or above 20–30%. This reflects the ultimate effectiveness of your marketing and sales alignment.

- Efficiency and Awareness Metrics: Track share of voice in relation to your CAC trendlines. If CAC is rising without a corresponding increase in market presence, your demand engine may be losing efficiency.

If you miss two or more of these guardrails for consecutive weeks, it’s a clear signal that your mix is off and requires recalibration.

A Smarter Way: The Brand vs. Demand Calculator

That’s why I built the calculator — to replace opinion with insight.

Answer a few quick questions about your company stage, funnel health, and competitive environment. The diagnostic then recommends:

- A brand vs. demand % allocation (e.g., 40/60)

- Performance guardrails to track

- A board-ready narrative for budget discussions

It’s not about turning marketing into a spreadsheet exercise — it’s about grounding your spend in data instead of emotion.

Try the Brand vs Demand Marketing Spend Allocation Calculator

The Bottom Line: Orchestrate, Don’t Choose

The best SaaS leaders don’t pick sides — they orchestrate both.

Brand builds leverage. Demand converts it. Together, they compound.

Here’s a structured approach to help you take decisive action and rebalance your marketing efforts for sustainable growth:

- Audit your spend. See how far the pendulum has swung.

- Benchmark your mix. Compare to peers at your stage.

- Set guardrails. Track SOV, CAC, and pipeline weekly.

- Reinvest in long-term demand. Prioritize earned and organic.

- Flex dynamically. Shift ± 5 points between brand and demand as needed.

So before your next CRO-CMO budget debate, take five minutes to run the calculator. Because in today’s market, clarity is the new competitive advantage.

Use the Brand vs. Demand Calculator to find your ideal mix and transform budget debates into strategic decisions backed by data.

Sources

- Brand Finance. “Not one size fits all: In the world of brand, B2B quietly takes centre stage.” 2025.

- Brand Finance. “Microsoft leads $3.34 trillion B2B brand landscape: How the top B2B brands engage and build value.” 2025.

- Search Engine Journal. “Brand Bias For Visibility In Search & LLMs: A Conversation With Stephen Kenwright.” July 17, 2025.

- Klickflow. “SaaS Conversion Rate Benchmarks: 2025 Industry Data.” (Blog)